Sustainability | Free Full-Text | Reduced Value Added Tax (VAT) Rate on Books as a Tool of Indirect Public Funding in the Cultural Sector

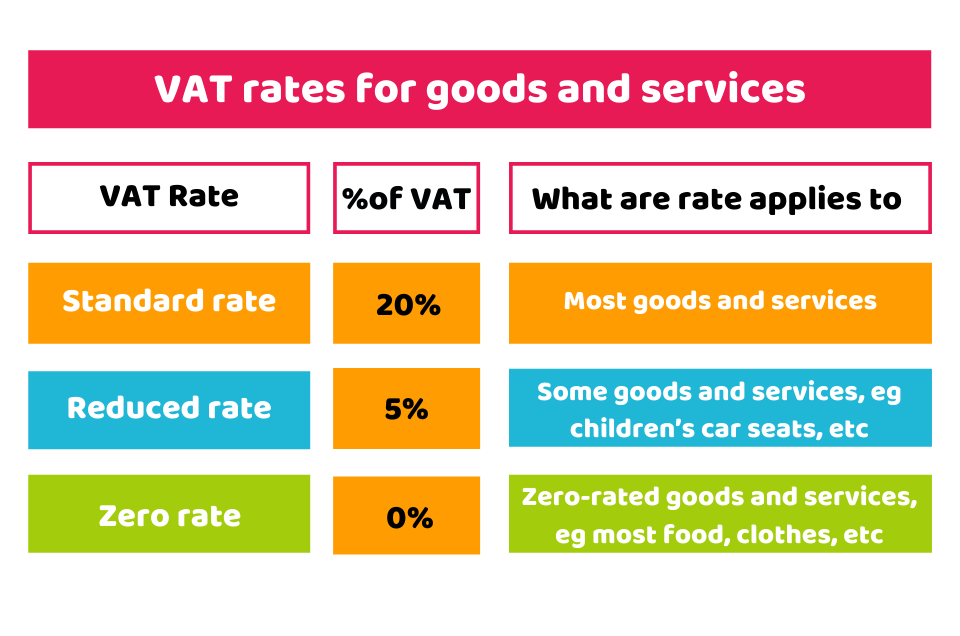

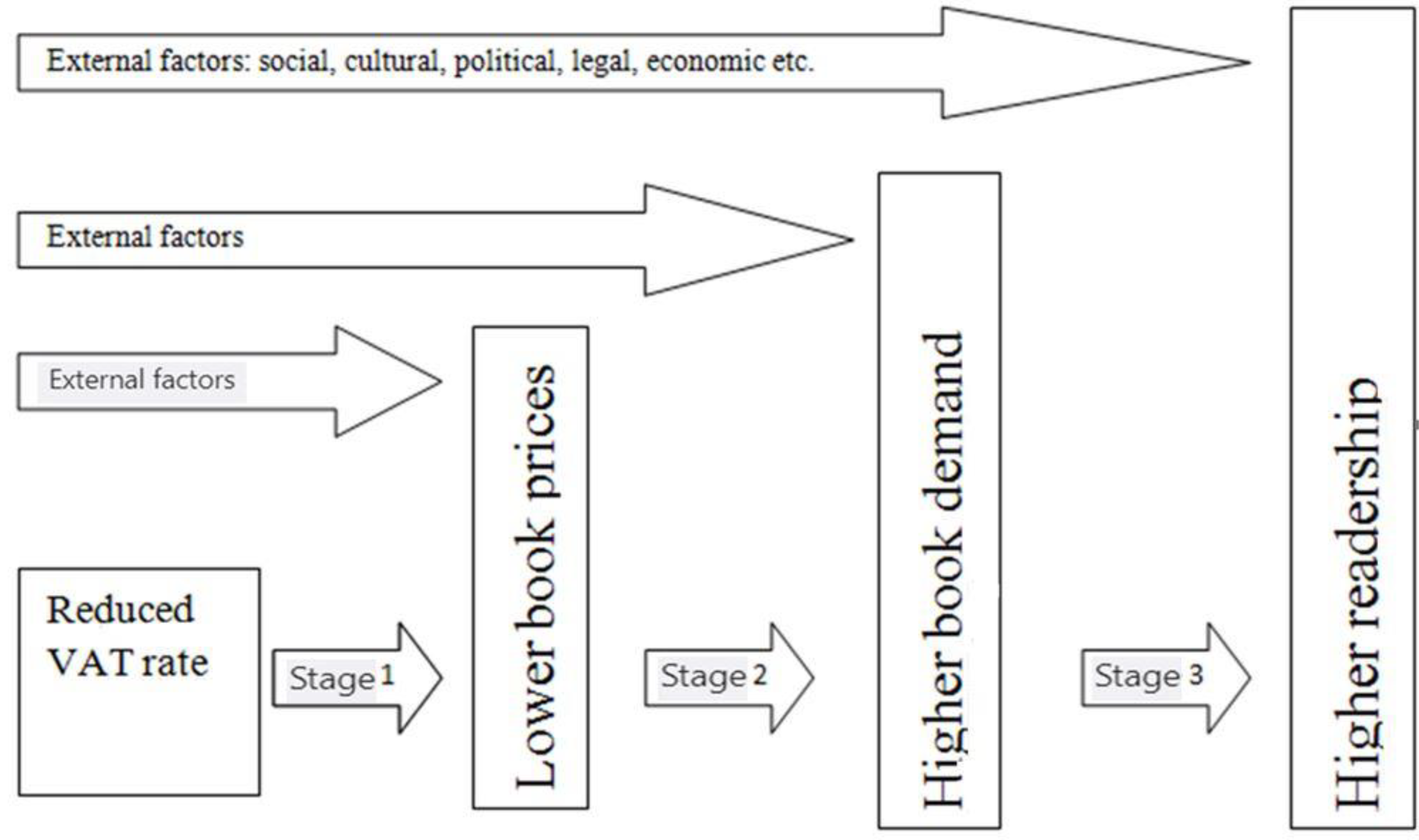

Rishi Sunak on Twitter: "To protect hospitality and tourism jobs, the 5% reduced rate of VAT will be extended for six months to 30th September. And even then, we won't go straight