Fillable Online FORM VAT 475 See rule-153(3) BEFORE THE HIGH COURT OF KARNATAKA Memorandum of Appeal against an Order Under Section 66 (1) of the Karnataka Value Added Tax Act, 2003 Appeal

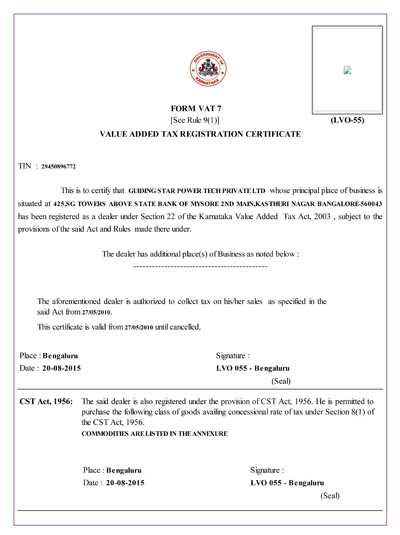

![VAT Authorities has no Power to assess Dealer during the Existence of Composition Certificate: Karnataka HC [Read Judgment] | Taxscan VAT Authorities has no Power to assess Dealer during the Existence of Composition Certificate: Karnataka HC [Read Judgment] | Taxscan](https://www.taxscan.in/wp-content/uploads/2018/01/Audit-Report-VAT-Taxscan.jpg)

VAT Authorities has no Power to assess Dealer during the Existence of Composition Certificate: Karnataka HC [Read Judgment] | Taxscan

![VAT Assessment post-GST: Karnataka HC stays Single Bench Order [Read Order] | Taxscan VAT Assessment post-GST: Karnataka HC stays Single Bench Order [Read Order] | Taxscan](https://www.taxscan.in/wp-content/uploads/2018/06/Land-Transactions-Karnataka-High-Court.jpg)