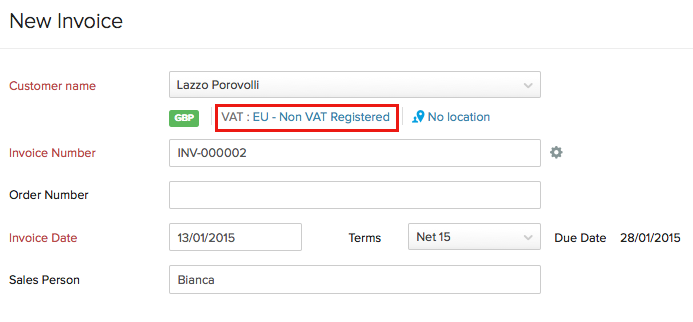

VAT, FBM from EU to UK for orders above 135 GBP - wrong VAT calculated by Amazon - General Selling on Amazon Questions - Amazon Seller Forums

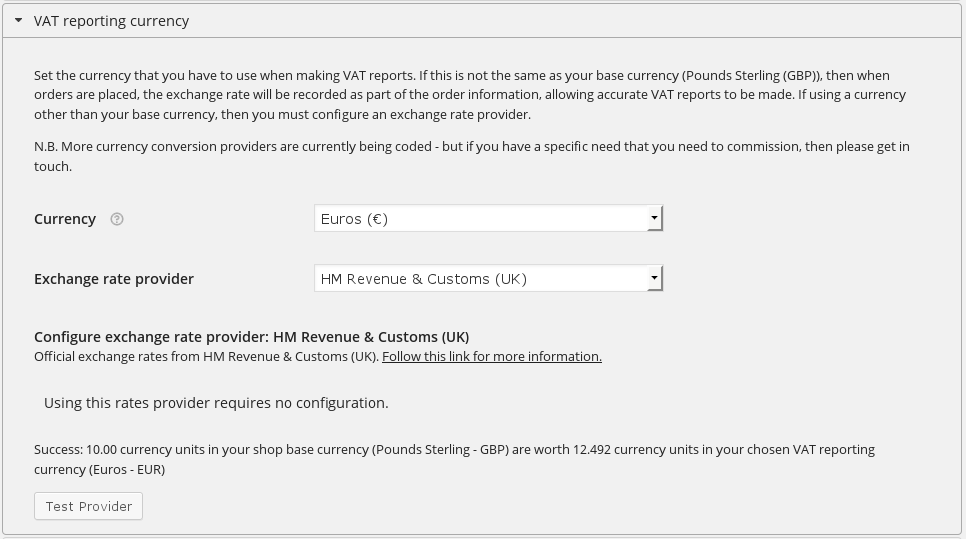

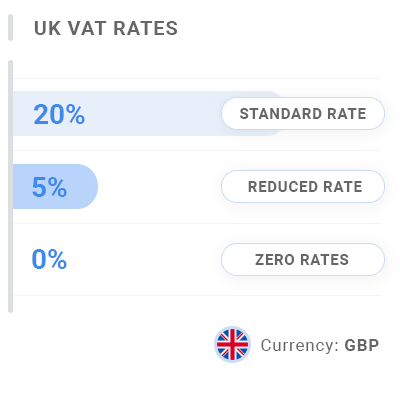

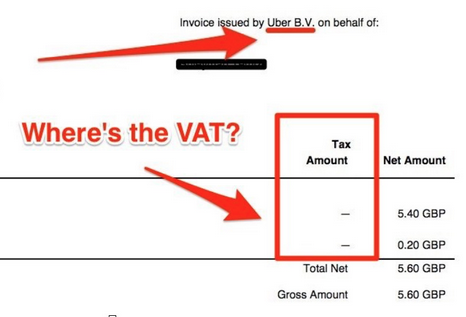

multiple VAT rates when positing amounts to GL accounts (UK) - Dynamics 365 Business Central Forum Community Forum

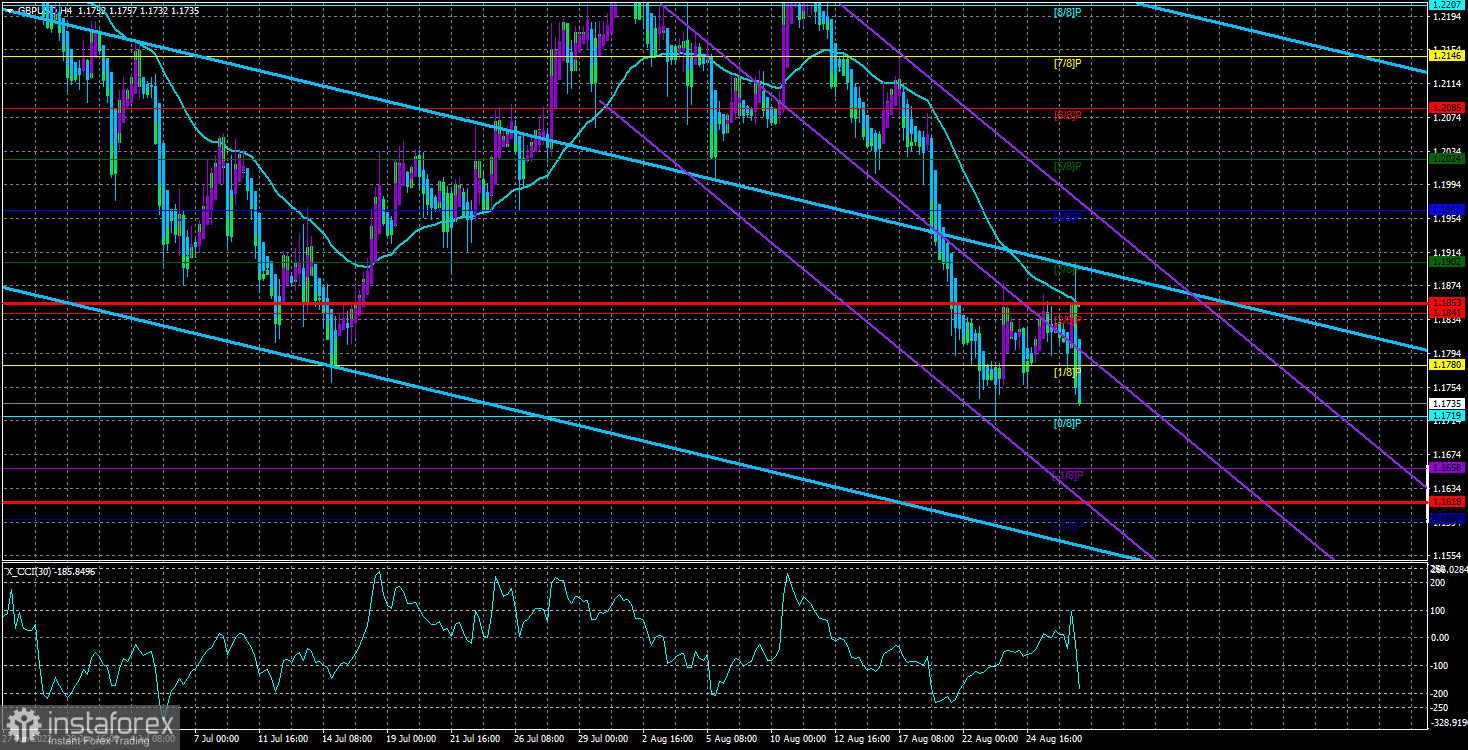

FX.co - Overview of the GBP/USD pair. August 29. Liz Truss rushes to the prime minister, like an armored train: a possible reduction in VAT by 5 is announced% - 2022-08-29

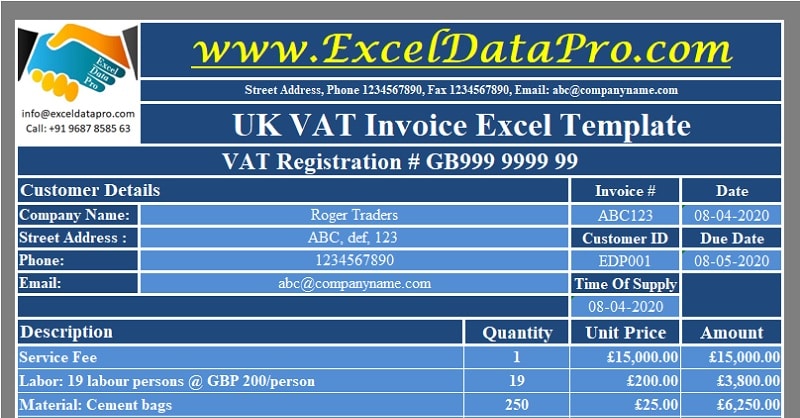

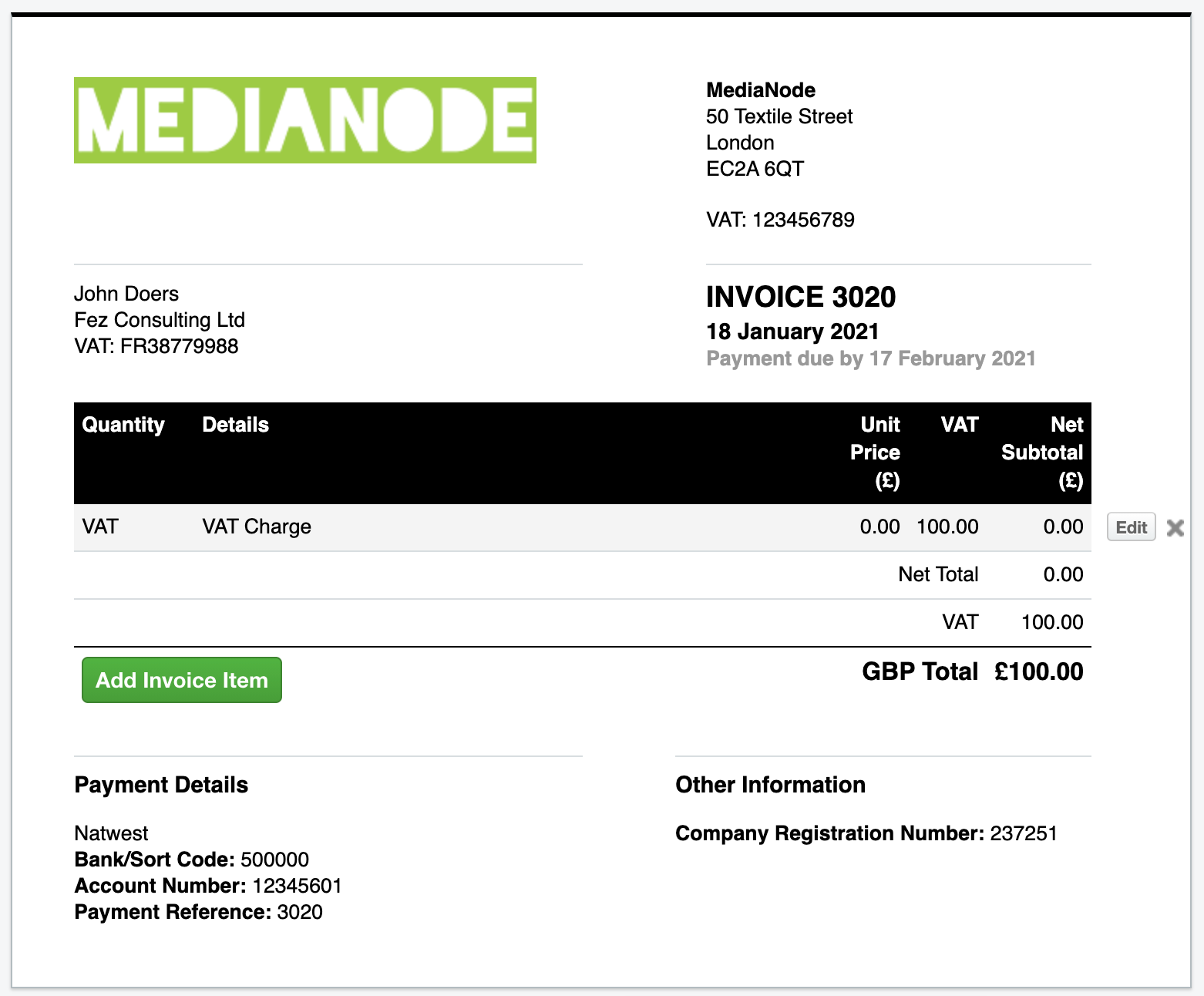

![Download] Free UK VAT Invoice Format in Excel Download] Free UK VAT Invoice Format in Excel](https://i0.wp.com/exceldownloads.com/wp-content/uploads/2022/06/UK-VAT-Invoice.png?fit=803%2C478&ssl=1)

![Download [Free] UK VAT Invoice with Multiple Taxes Format In Excel Download [Free] UK VAT Invoice with Multiple Taxes Format In Excel](https://i0.wp.com/exceldownloads.com/wp-content/uploads/2022/06/UK-VAT-Multiple-Tax-Invoice-Template.png?fit=901%2C449&ssl=1)