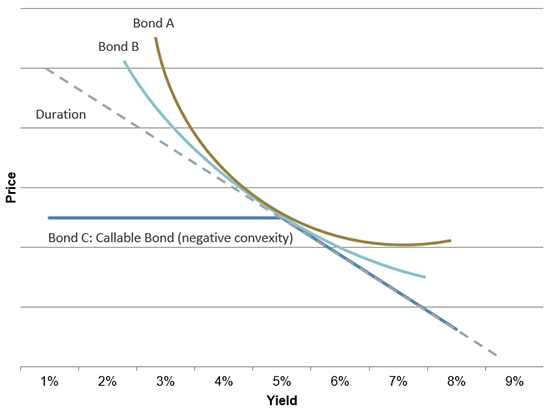

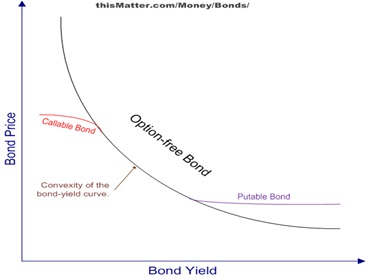

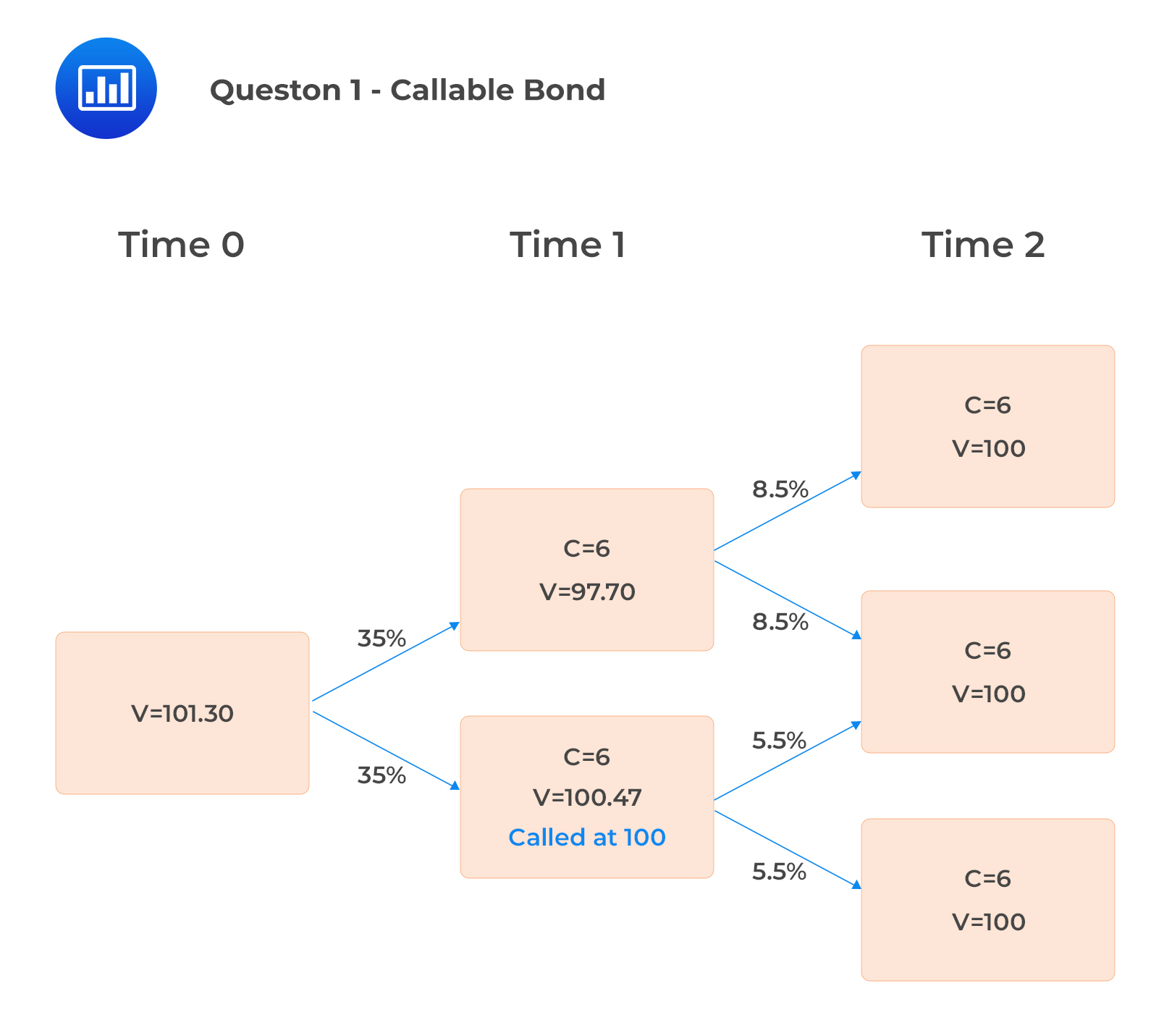

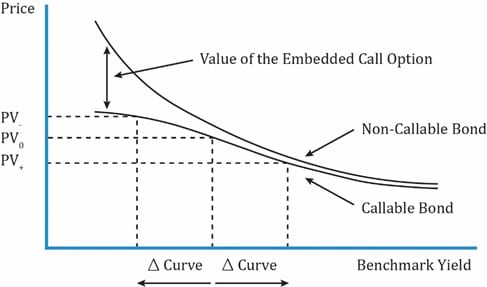

Effective Durations of Callable, Putable, and Straight Bonds - CFA, FRM, and Actuarial Exams Study Notes

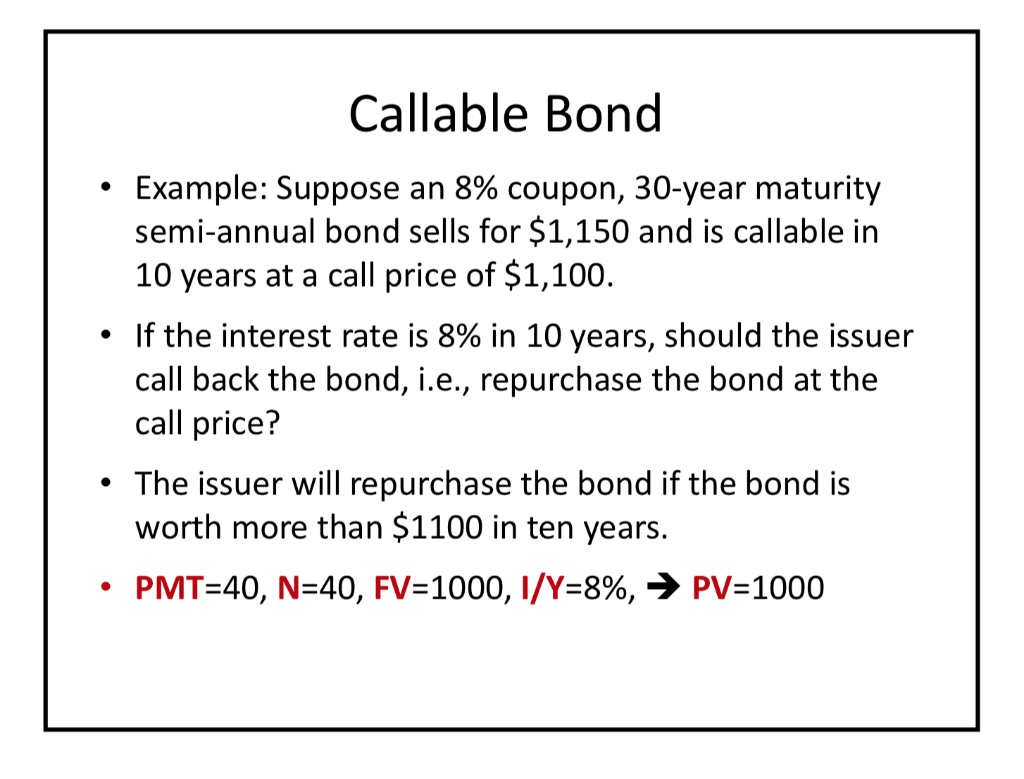

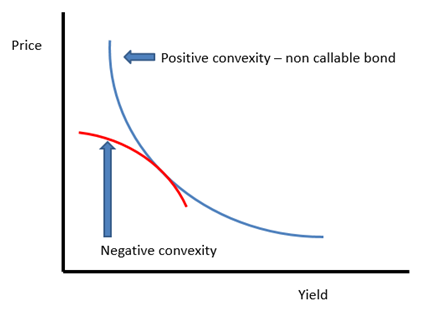

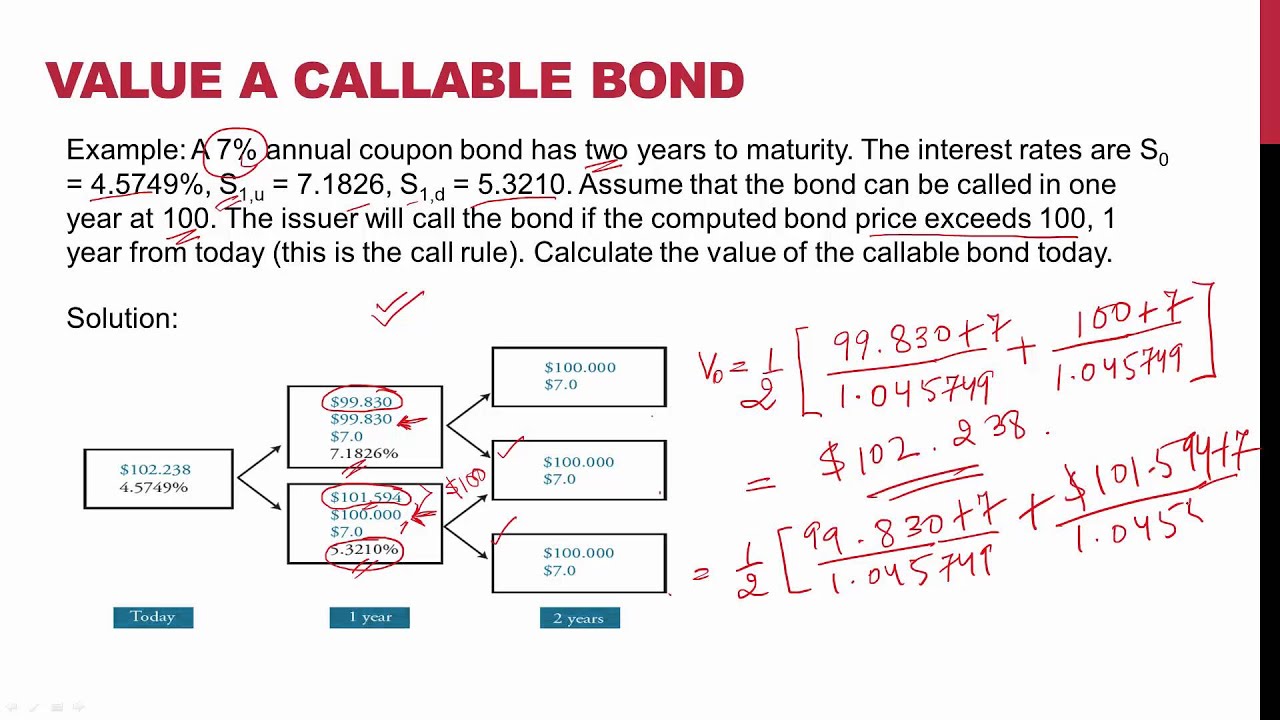

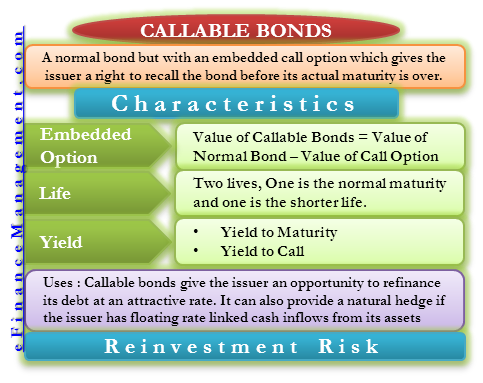

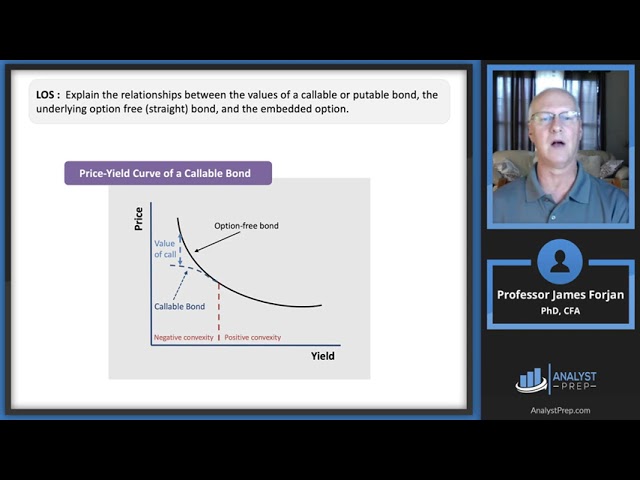

Callable bonds Bonds that may be repurchased by the issuer at a specified call price during the call period A call usually occurs after a fall in market. - ppt video online