How to pay 0% VAT on Amazon orders within the European Union. (EU Reverse Charge Mechanism) - Points to be Made

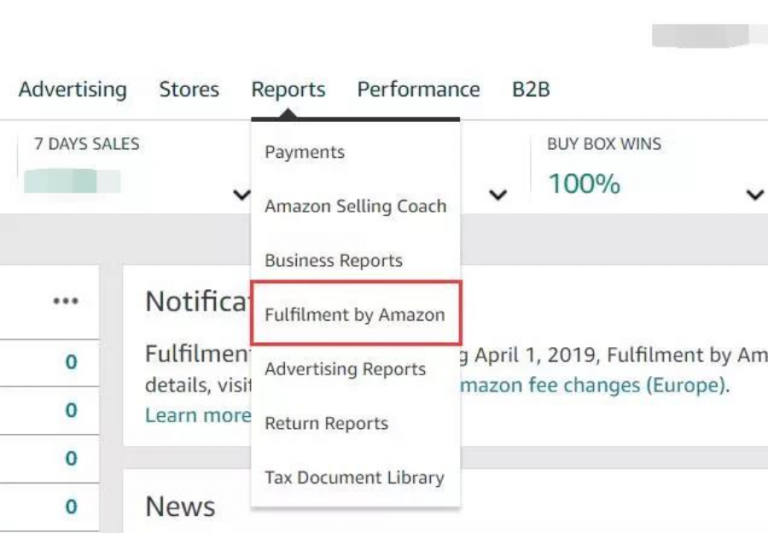

Need help trying to find Amazon VAT Transaction Reports for VAT Filing in EU - General Selling on Amazon Questions - Amazon Seller Forums